We are living in the age of Amazon. The distribution and service giant has disrupted industries across the globe, from retail and big box stores to media, and even how people shop for groceries.

The Amazon Effect has stretched so vast, it has even dug its claws into the cleaning industry, serving as a driving force in the competition for labor in addition to impacting end-user relationships with distributors and product providers. There are countless ways for facility managers and providers to order products, tools, and equipment, and more offerings to pick from than ever before.

This trend isn’t new; in fact, Bill McGarvey pointed it out in an article he wrote for CMM in 2017. “Never before have custodians had as many cleaning products and equipment options available at their fingertips as they do now,” he wrote. “While this may seem like a benefit for the facilities they are servicing, this unbridled access often leads to confusion for both the custodian and the manager in charge of purchasing the products.”

Despite the countless choices available to facility mangers and other in-house providers, the facility manager-distributor relationship is still strong, and the data is there to back this up. According to CMM’s 2019 In-House/Facility Management Benchmarking Survey, many facility managers are still turning to distributors, signifying the importance of these relationships—at least for now.

The FM-Distributor Relationship

Professionals working in the education sector were a driving force behind the results of CMM’s 2019 In-House/Facility Management Benchmarking Survey. Almost two-thirds of the 508 survey respondents work in education facilities, with 75 percent of college/university professionals and 70 percent of K-12 professionals using distributors for purchasing to a large extent. Among respondents from education, health care, commercial, hospitality, retail, industrial, and recreation/transportation facilities, 66 percent primarily turned to distributors for product purchasing.

Facility managers rely on distributors for more than just placing orders. Eighty-three percent expect product demos from their distributors, while 82 percent expect technical support and 77 percent expect training. Only 39 percent expect online orders or e-commerce capabilities, which seems to be in line with online purchasing trends revealed in this year’s survey.

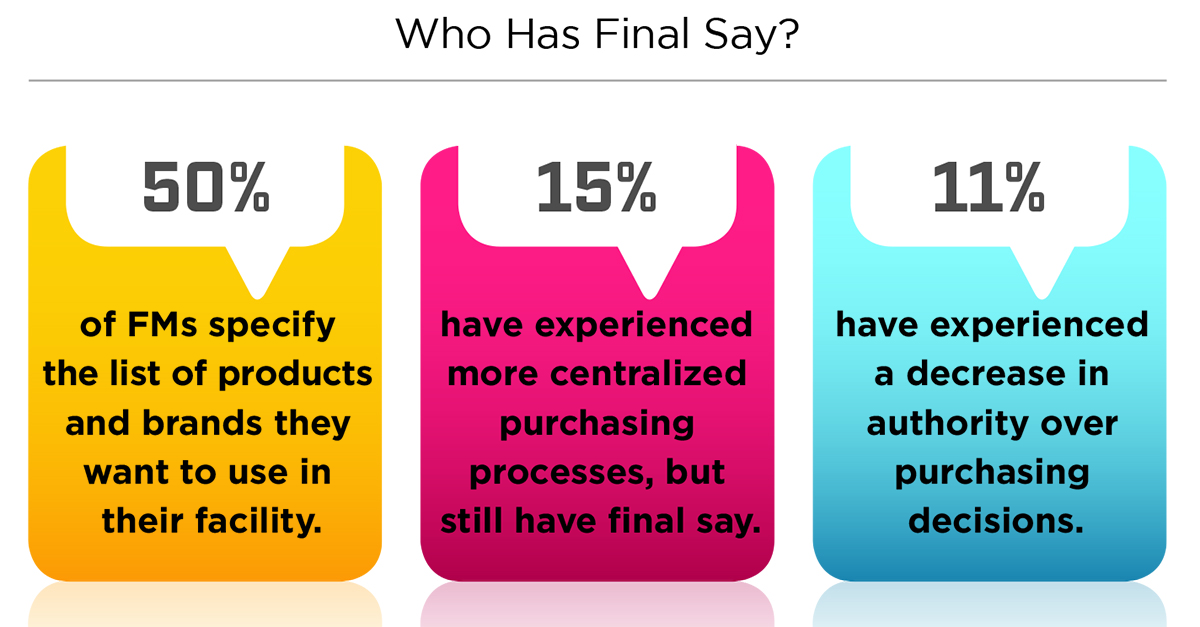

Purchasing Authority

Given the large role facility manager play in keeping our buildings clean, it makes sense they would have the authority to select their own products and equipment. In fact, almost two-thirds of survey respondents (63 percent) said they are responsible for making their own purchasing decisions, and most of those who have that authority—two-thirds—still prefer to utilize a distributor over other types of suppliers. This is just one more example of how the facility manager-distributor relationship continues to remain tight.

Help Carrying the Load

Participants in this year’s in-house/facility management benchmarking survey carry a heavy load. Almost half of them are responsible for 11 or more facilities; 37 percent of them are responsible for more than 20 facilities. Additionally, about a quarter of them (23.2 percent) are responsible for at least 2 million square feet of real estate. With this in mind, it’s no wonder facility managers could use a bit of outside expertise from their distributors to help with selecting the right products.

Stay Tuned

More data and statistics, including budget concerns, staffing issues, trends, and much more, will be included in the May 2019 issue of CMM. Download all the data and statistics from the 2019 Facility Management Benchmarking Survey below.